Easy to Pass Funding In One Course

The goal of a success trader is to make the best traders, Money is secondary.

Recurring payment VISA, Mastercard

The goal of a success trader is to make the best traders, Money is secondary.

Recurring payment VISA, Mastercard

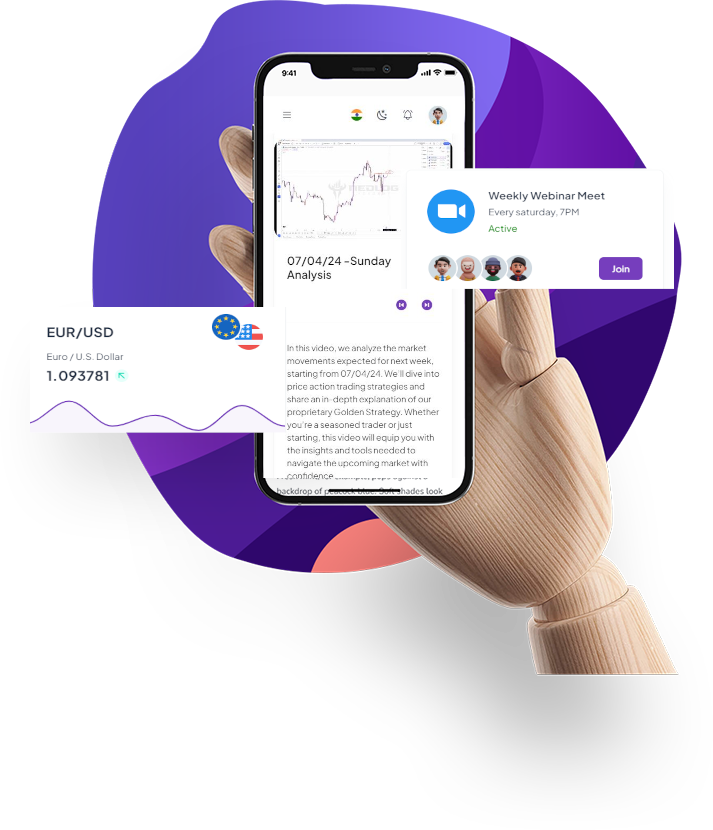

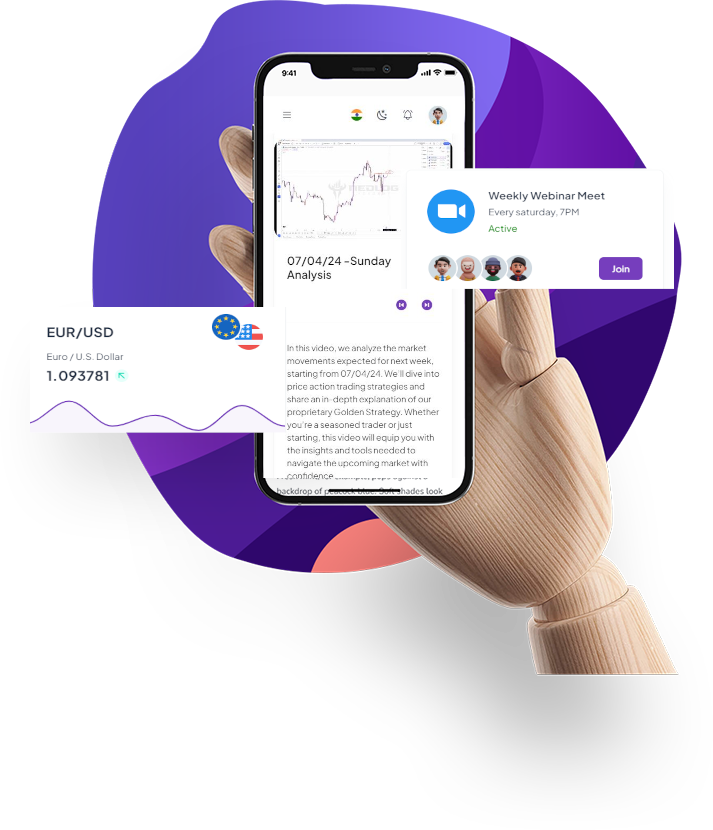

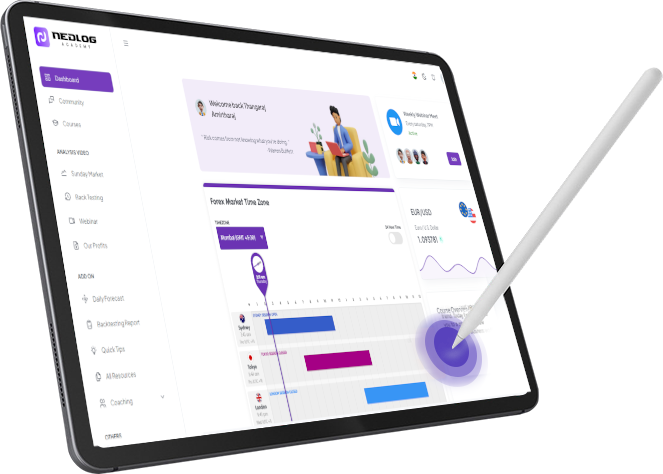

Stay informed with our integrated Forex Time Zone Map, highlighting the active trading sessions across the globe. Easily track the London, New York, Tokyo, and Sydney sessions to optimize your trading strategies based on market activity.

Join our exclusive student webinars every Saturday. Access the link directly from your dashboard to participate in live sessions

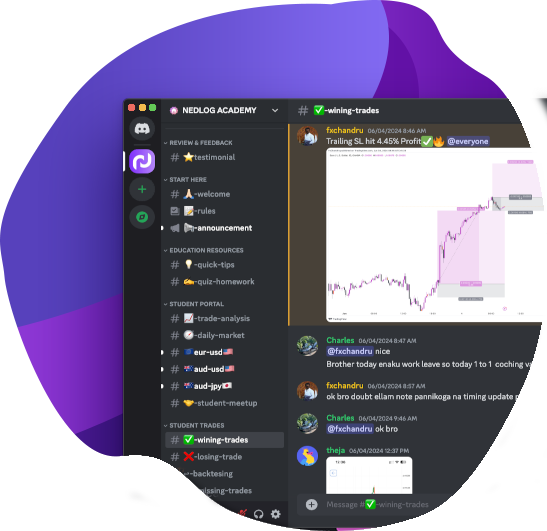

Join our vibrant Discord community, where members actively share trading ideas, insights, and strategies. get instant feedback, and stay connected with a supportive network of like-minded individuals.

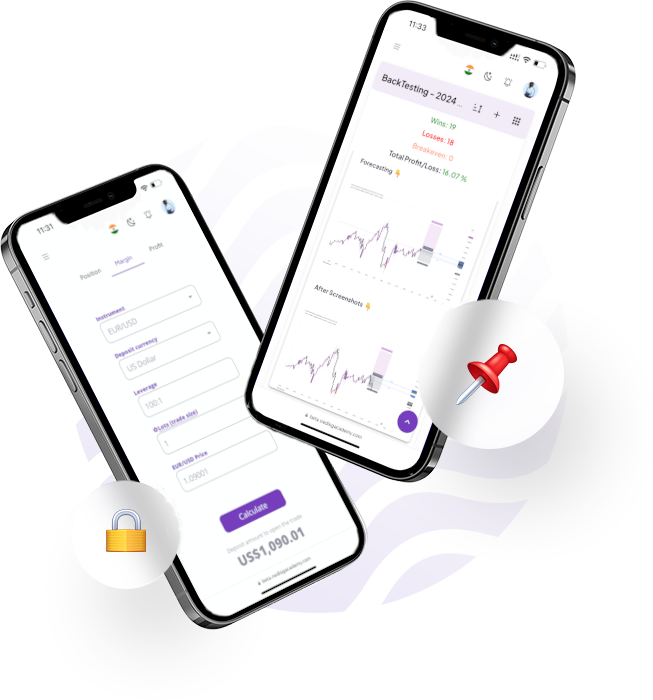

All Integration tools and software very safe and secure